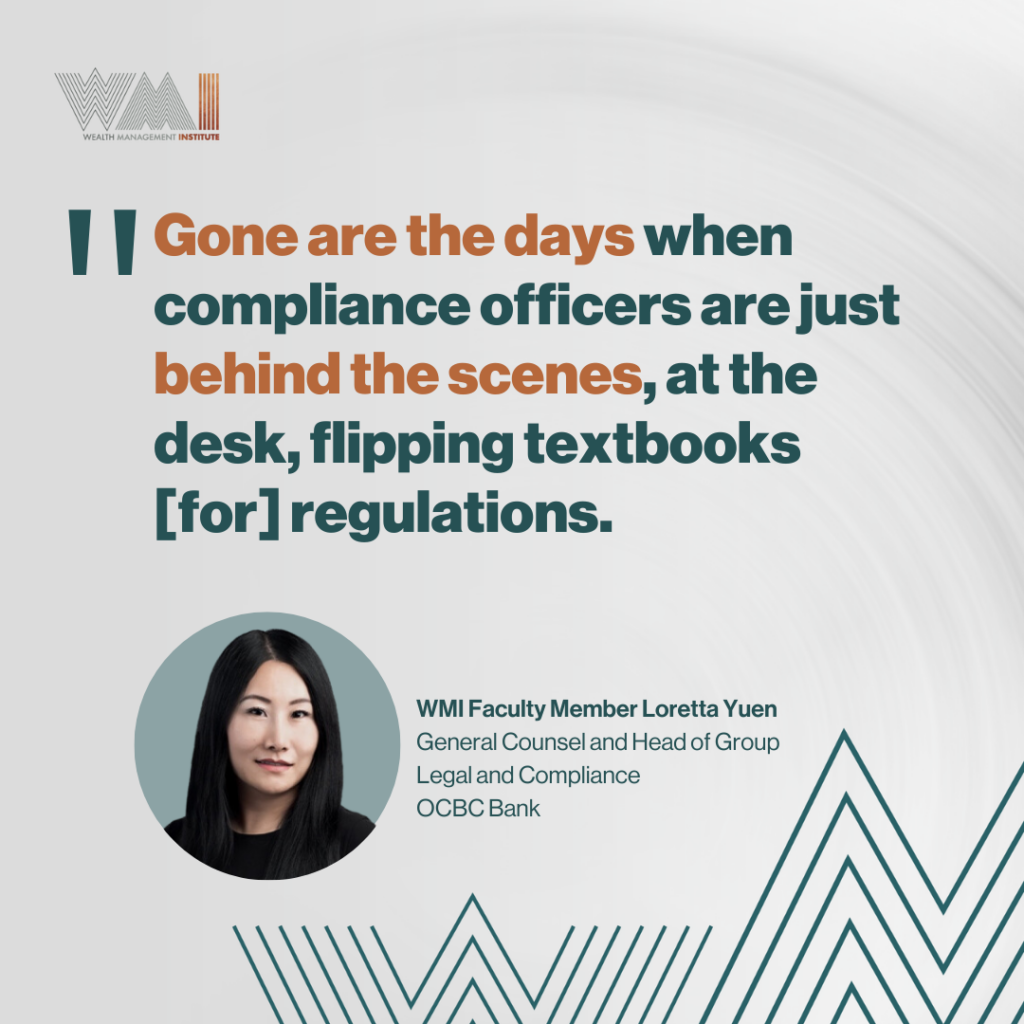

As 2024 beckons, the domain of compliance is undergoing transformative changes. The scope of a compliance officer’s role is evolving beyond foundational knowledge, extending to multifaceted skills that cater to the sector’s evolving demands. WMI’s faculty member Loretta Yuen, the General Counsel and Head of Group Legal and Compliance at OCBC Bank, shares her valuable insights into the current trends and indispensable qualities that define a top-tier compliance officer.

Trends Shaping the World of Compliance

The compliance sector currently finds itself under the influence of two significant trends: anti-fraud compliance and sanctions compliance. With digital payment scams proliferating, a concentrated focus on anti-fraud initiatives is paramount. “It is necessary for compliance officers to be agile and practical in their approach to combat these threats,” says Loretta.

Harnessing innovative tech solutions and fostering a robust collaboration amongst key players – including banks, e-commerce platforms, law enforcement agencies, and end-users – is integral to establishing a fortified front against fraud. Concurrently, the intricacies of sanctions compliance demand a profound grasp of global regulations and adeptness in risk management, especially given the prevailing geopolitical scenarios.

Important Skillsets Every Compliance Officer Needs

Agility

As always, agility remains as a cornerstone of success, with compliance officers needing to adapt swiftly to changing regulations and industry dynamics. “Gone are the days when compliance officers are just behind the scenes, at the desk, flipping textbooks and regulations,” quipped Loretta as she highlighted how the role – and expectations – of compliance officers is now more elevated in the financial sector. “You need to run with your business, see what is your strategy and map your regulatory outcomes to that”.

Practicality

Practicality entails finding pragmatic solutions that align with business objectives while ensuring compliance. “Compliance officers must possess the acumen to advocate for and implement measures that align with their organisation’s vision,” stressed Loretta. This ensures that compliance efforts are integrated into the overall business strategy, mitigates risks, and promotes a culture of ethical conduct throughout the organisation.

Related Articles:

Servant Leadership

For aspiring compliance leaders, Loretta emphasised the importance of servant leadership. This approach involves building strong teams, understanding individual aspirations, and empowering team members at all levels. By lifting others and helping them reach their full potential, compliance leaders can drive meaningful change and foster a culture of compliance excellence within organisations.

Continuous Learning and Giving Back

Staying abreast of industry trends and changes is a perpetual challenge for compliance professionals. Loretta shared her personal approach, which involves a combination of reading newspapers, engaging in discussions with industry peers, and actively following developments through media and social channels.

“By immersing myself in a wealth of information, I can ensure that I remain well-informed and equipped to address emerging compliance challenges,” highlighted Loretta. In addition to keeping pace with industry trends, Loretta recognises the importance of giving back to the compliance community. As a fervent advocate for imparting practical knowledge, she actively engages in teaching and sharing her experience at WMI. By equipping future compliance officers with practical insights and skills, she contributes to uplifting the standards of compliance in Singapore.

Conclusion

As the compliance landscape evolves at an unprecedented pace, professionals in the field must adapt and equip themselves with essential skills. Effective communication, influencing capabilities, stakeholder relationship management, agility, practicality, passion for continuous learning, and embracing servant leadership are paramount to success. By embracing these skills and dedicating themselves to ongoing education and professional growth, compliance officers can navigate the intricate challenges and make a lasting impact in the ever-evolving world of regulatory change and risk management .

Hone in on your compliance and corporate skillsets through WMI’s Advanced Compliance Programmes, including Retail Banking and Fintech Regulation delivered by Loretta Yuen. Beyond grasping regulatory frameworks and best practices across different aspects in the financial sector, participants will be put through a rigorous curriculum of between four and twelve modules, leading to an Advanced Certificate, Advanced Diploma or Graduate Diploma certification. Through upskilling and improving on soft skills in the workplace, compliance officers can weather challenges and opportunities that 2024 brings.

Take your compliance career to the next level with WMI’s Advanced Compliance Programmes